Ever since Donald Trump returned to the White House, he has shifted sharply toward supporting cryptocurrency. What once seemed risky or fringe under previous administrations now looks central to his agenda. From creating a strategic Bitcoin reserve to promoting meme coins and raising crypto policy voices in government, Trump is positioning himself—and the U.S. as a major player in digital assets. But this rise doesn’t come without trade-offs or risks.

How Trump’s Strategic Bitcoin Reserve proposal reshapes U.S. crypto policy

One of the biggest steps Trump has taken is the executive order to establish a strategic Bitcoin reserve and a U.S. Digital Asset Stockpile. Using crypto assets that were seized by law enforcement in the past, the government won’t spend taxpayer money to build this reserve. The goal is to hold onto Bitcoin, plus other seized crypto, and not sell it, seeing it instead as a strategic asset. This policy signals a major shift in how the U.S. treats crypto not just as speculative market tools but as parts of its financial and national strategy.

That change has excited many in the crypto industry. People who invested in Bitcoin or blockchain tech hope for clearer rules, lighter regulation, and new markets. But observers warn that while the reserve idea sounds good, turning it into a stable policy may prove far harder in practice.

What launching the $TRUMP memecoin reveals about branding, risk, and profit

Another piece in Trump’s crypto rise is the launch of the $TRUMP memecoin. It exploded onto the market just before Trump took office, backed by media hype and his popular brand. Because Trump’s family and partners controlled large parts of the supply, the memecoin gained value fast. Many early buyers saw big profits. Others lost money as prices jumped up and crashed.

The memecoin showed how powerful branding can be in crypto. When you have a famous name, you get attention, trust or interest, and often speculation. But memecoins also carry more risk. With minimal regulation, volatile value swings, and often little real utility beyond popularity, they can lead to quick gains for some and heavy losses for others.

The administration also holds a crypto summit, bringing leaders of exchanges, blockchain firms, and investors into direct conversation. These meetings allow Trump’s team to signal its priorities and for the industry to point out what changes it wants, such as lighter regulatory oversight, tax clarity, or easier rules for initial coin offerings.

How markets have reacted urges and volatility under Trump-crypto era

Markets have responded quickly to Trump’s crypto moves. Bitcoin surged past $100,000 in late 2024 after Trump’s election win, driven by hopes of lighter regulation and favorable policy. But markets are not steady. After highs, Bitcoin and other cryptocurrencies pulled back. Ethereum and altcoins saw drops, raising concerns that some of the price gains were driven by sentiment rather than fundamentals.

Speculators and early investors cheered, but the volatile swings remind many that crypto remains risky. Rapid gains attract attention, but also the possibility of fast losses. Those who buy in later often pay higher prices or get caught in crashes.

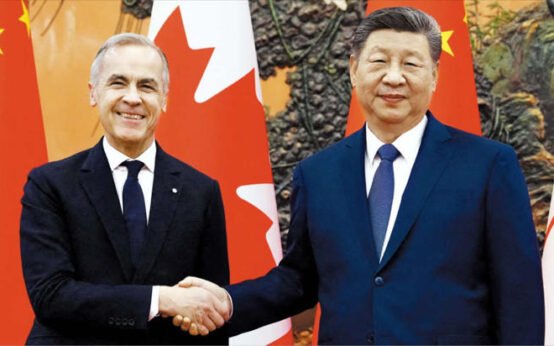

Canada and China reset strategic partnership under Trump pressures

Canada and China reset strategic partnership under Trump pressures  Trump Aggressive Push to Oust Maduro: Drugs, Gangs, Oil, and Geopolitical Dominance

Trump Aggressive Push to Oust Maduro: Drugs, Gangs, Oil, and Geopolitical Dominance  Trump Faces Backlash as Canadian Tourism to US Plummets in 2025

Trump Faces Backlash as Canadian Tourism to US Plummets in 2025  Trump ‘Patriot Games’ Announcement Sparks Widespread Dystopian Parallels to ‘The Hunger Games’

Trump ‘Patriot Games’ Announcement Sparks Widespread Dystopian Parallels to ‘The Hunger Games’  Trump Travelled on at Least 8 Epstein Flights, Over 11,000 New Files Released

Trump Travelled on at Least 8 Epstein Flights, Over 11,000 New Files Released  Donald Trump Sues BBC for Billions Over Allegedly Edited January 6 Speech

Donald Trump Sues BBC for Billions Over Allegedly Edited January 6 Speech