Pakistan has started a new chapter in its search for energy security by inviting American companies to invest in oil and gas exploration. The government recently announced that U.S. firms can now participate in bidding for both offshore and onshore energy blocks. This move shows Pakistan’s commitment to attract foreign investment and reduce its reliance on costly imported fuels.

A Fresh Start in U.S.-Pakistan Energy Relations

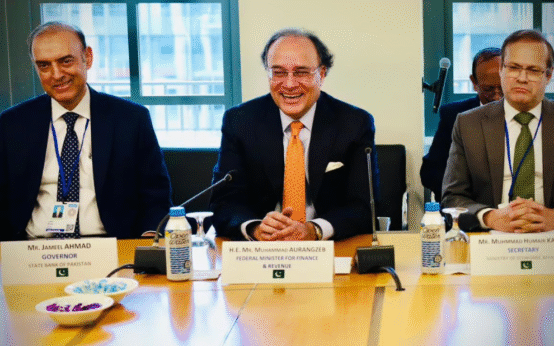

In Islamabad, the petroleum minister met with American diplomats to highlight the new opportunities. He assured U.S. investors that Pakistan is ready to provide support and fast-track energy projects. The U.S. Chargé d’Affaires welcomed the invitation and noted that American companies are already showing strong interest in Pakistan’s energy, oil, and mineral resources.

This discussion reflects the improving ties between the two countries. Only a few days earlier, Pakistan and the United States signed a trade agreement focused on energy cooperation. The deal reduces tariffs and makes it easier for U.S. firms to enter the Pakistani market. For Pakistan, it is an important step to attract investment, create jobs, and strengthen its economy.

Offshore Oil and Gas Blocks: A Big Investment Opportunity

The government has opened 40 offshore blocks for bidding. These blocks are located mainly in the Makran and Indus basins. Each block will require an investment of at least $150 million, and together they could bring nearly $6 billion into the country. Offshore drilling is risky but can be highly rewarding. If successful, Pakistan could unlock new energy reserves that reduce the need for expensive fuel imports.

Alongside offshore areas, Pakistan has also invited investors to bid for 23 onshore exploration blocks. These are easier to develop compared to deep-sea drilling and require smaller initial investments around $65 million per block. If foreign firms show interest, the total onshore investment could reach $1.5 billion. For American companies, this offers a safer and less costly option while still delivering good returns.

Past Challenges in Pakistan’s Energy Sector

Pakistan’s energy exploration history has been filled with challenges. In 2019, a major offshore project with ExxonMobil raised hopes, but the drilling did not find enough oil or gas to continue. Energy companies have also faced financial hurdles such as circular debt, where power companies owe money across the entire energy supply chain. These setbacks slowed down exploration and scared off many foreign firms.

By reopening bidding now, the government wants to change this trend. Officials believe that better policies, investor-friendly reforms, and support from institutions like the Special Investment Facilitation Council (SIFC) will give international companies more confidence to invest.

Energy Security and Economic Growth

At the same time, Pakistan is improving its legal framework to reduce risks for investors. Fast-track approvals, tax reforms, and lower tariffs are part of this effort. With help from the United States and other partners, the government hopes to bring advanced drilling technologies, modern equipment, and skilled expertise into the country.

Pakistan spends billions every year on importing liquefied natural gas and oil. This puts a heavy burden on the national budget and weakens the currency. By increasing local production, Pakistan hopes to save foreign exchange, lower energy costs, and provide cheaper electricity for homes and businesses.

In Our Defence Podcast: Is Bangladesh Becoming East Pakistan 2.0?

In Our Defence Podcast: Is Bangladesh Becoming East Pakistan 2.0?  Himanta Taunts Gogoi “He Can Contest Elections in Pakistan”

Himanta Taunts Gogoi “He Can Contest Elections in Pakistan”  Pakistan FM IMF Cannot Impose Conditions on National Interests

Pakistan FM IMF Cannot Impose Conditions on National Interests  PSX Market Surges IMF Nears Staff-Level Agreement

PSX Market Surges IMF Nears Staff-Level Agreement  Pakistan’s Struggle to Reduce Poverty

Pakistan’s Struggle to Reduce Poverty  Pakistan Among Early Adopters of Wi-Fi 7 in Asia-Pacific

Pakistan Among Early Adopters of Wi-Fi 7 in Asia-Pacific