Kenya’s financial markets entered a turbulent phase as shifting global valuations and unexpected movements in US employment data unsettled investors. The week started with optimism, yet a rapid change in market sentiment pushed traders toward caution. This shift became evident as foreign investors reassessed the risk landscape, leading to a notable dip across Kenyan equities and fixed-income securities.

How Global Valuation Concerns Are Influencing Local Investor Behaviour

The latest market retreat in Nairobi reflects a broader pattern seen across emerging economies. As global valuations tighten and strong US labour numbers heighten expectations of prolonged high interest rates, many investors prefer safer assets. This rising preference for stability is compelling market participants in Kenya to adjust their strategies, especially those heavily exposed to high-risk sectors.

The momentum that once drove aggressive buying has now been replaced with a defensive mindset, fueling sell-offs across several counters.

Impact of US Jobs Data on Kenya’s Financial Market Stability

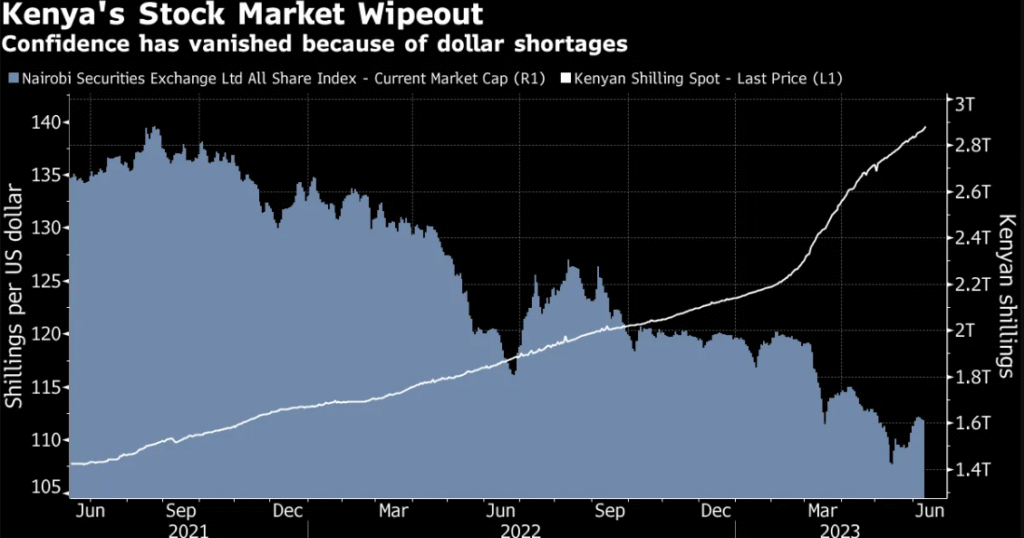

The release of robust US job figures created a ripple effect that stretched far beyond American borders. Higher employment numbers often signal economic strength, but they also increase the likelihood of the Federal Reserve maintaining a firm stance on interest rates. For Kenyan markets, this dynamic weakens local currency prospects and encourages foreign investors to redirect funds toward US-dollar-denominated assets. Consequently, the Nairobi Securities Exchange experienced increased volatility as traders reacted to potential capital outflows.

Investor Uncertainty Grows as Currency Pressures Intensify

The Kenyan shilling continues to face sustained pressure as global markets digest the latest US data. Currency weakness typically increases import costs and narrows profit margins for listed companies, further discouraging new investments. Moreover, the fear of prolonged inflation adds another layer of uncertainty. As these challenges accumulate, investors adopt a wait-and-see approach, seeking greater clarity before making significant financial moves.

Gulf states lobby US against Iran military strike

Gulf states lobby US against Iran military strike  US to host officials from Denmark and Greenland as Trump renews takeover threats

US to host officials from Denmark and Greenland as Trump renews takeover threats  Canadians aren’t relenting: US travel boycott holds strong

Canadians aren’t relenting: US travel boycott holds strong  India Wary as US Backs Pakistan With F-16 Upgrades and Mineral Projects

India Wary as US Backs Pakistan With F-16 Upgrades and Mineral Projects  Growing discontent in the U.S. as many Americans turn against Trump’s presidency

Growing discontent in the U.S. as many Americans turn against Trump’s presidency  Chinese gaming mogul files lawsuit to reclaim US $42 M from ex explosive counters and shocking claims follow

Chinese gaming mogul files lawsuit to reclaim US $42 M from ex explosive counters and shocking claims follow