Hong Kong’s commercial real estate sector is finally showing signs of steady improvement. After years of weak demand, high vacancy rates, and falling rents, the city’s office leasing market has now recorded growth for the fourth month in a row. This rebound highlights not only a shift in business confidence but also the resilience of Hong Kong as a leading global financial hub.

Financial Sector Demand Drives Leasing Momentum in Hong Kong

One of the biggest drivers behind the rebound in Hong Kong’s office leasing activity is the renewed demand from the financial services industry. With global markets regaining stability and the pipeline of initial public offerings strengthening, financial institutions are expanding their office footprint.

Hong Kong has already emerged as the global leader in IPO activity in 2025, with nearly 200 companies filing for listings in the first half of the year. This surge has fueled demand for high-quality office space in Central, the city’s premier business district. A landmark deal underscored this trend when Jane Street, one of the world’s largest trading firms, signed a lease for over 220,000 square feet the biggest office transaction in Central in several years.

This growing appetite from financial firms has encouraged landlords and property developers, who now see early signs that demand is returning to pre-pandemic patterns.

Stabilization in Office Rents and Vacancy Rates

Although Hong Kong still has one of the highest vacancy rates in Asia, the numbers are beginning to stabilize. In Central, vacancy has eased slightly from 7.1% to 6.9%, reflecting increased leasing activity. Rents, which fell sharply over the past five years, are also showing early signs of stabilizing, though they remain about 25% lower than their peak levels.

According to real estate analysts, this stabilization marks an important psychological turning point. Landlords are now more confident about negotiating leases, and tenants are starting to lock in deals before rents climb higher again.

Expanding Demand Across Secondary Business Districts

The recovery is not limited to Central alone. Other submarkets such as Wanchai, Causeway Bay, and Tsim Sha Tsui are seeing positive leasing activity as well. These districts, often chosen by professional services firms and mid-sized companies, are becoming attractive because they offer relatively lower rents compared to Central while still providing good connectivity and modern facilities.

In the first half of 2025, these submarkets recorded a net positive uptake of office space, signaling that companies are willing to expand or relocate into cost-efficient yet strategically located areas.

Challenges of Oversupply and Market Uncertainty

Despite the positive momentum, significant challenges remain. Oversupply continues to be a major concern, especially in emerging business zones like Kowloon East and Hong Kong East, where large amounts of new office space remain empty.

Developers and property owners in these districts face more pressure, as demand is still concentrated in Central and other established hubs.

Moreover, although leasing volumes have improved, rents across the city are still down by almost 8% year-on-year. Analysts caution that unless demand continues to grow at a steady pace, Hong Kong could still face difficulties balancing supply with actual tenant needs.

Will Hong Kong’s Office Leasing Market Continue to Recover?

Looking ahead, experts believe that the next six to twelve months will be crucial in determining whether the market’s rebound becomes a sustainable recovery. If IPO activity remains strong and financial firms continue expanding, Central is likely to stabilize further. This could then have a ripple effect on secondary districts, reducing vacancy rates citywide.

However, risks remain. Global economic slowdowns, rising interest rates, or political uncertainties could weigh on demand. Additionally, the oversupply issue in emerging districts must be addressed to avoid prolonged downward pressure on rents.

Still, with four months of consecutive leasing growth and renewed demand from high-value sectors, many analysts are cautiously optimistic. If current trends hold, Hong Kong may finally be entering a new cycle of market stability.

North Korea Revives Drone Claims, Rejects Seoul’s Outreach Efforts

North Korea Revives Drone Claims, Rejects Seoul’s Outreach Efforts  Hong Kong Primary Home Sales Set for Decade High in 2026, Driven by Demand for Small Flats

Hong Kong Primary Home Sales Set for Decade High in 2026, Driven by Demand for Small Flats  China Grid Equipment Maker Sieyuan Eyes Hong Kong Listing After 665% Share Surge

China Grid Equipment Maker Sieyuan Eyes Hong Kong Listing After 665% Share Surge  Hong Kong Urged to Empower Women in the Workforce

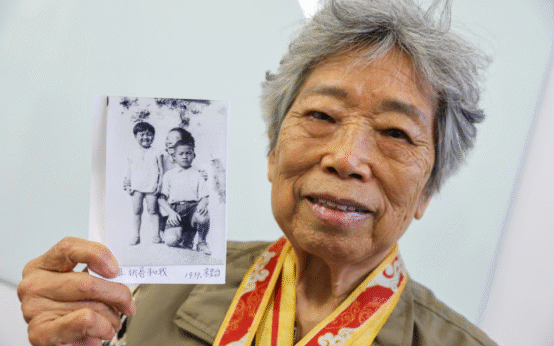

Hong Kong Urged to Empower Women in the Workforce  Light shining on dark days of Japanese occupation of Hong Kong

Light shining on dark days of Japanese occupation of Hong Kong  Trump son hypes bitcoin on Hong Kong leg of Asia trip

Trump son hypes bitcoin on Hong Kong leg of Asia trip