OpenAI has begun reshaping its financial agreements with Microsoft, aiming to reduce the share of profits paid to its biggest partner. Current arrangements give Microsoft around 20 percent of OpenAI’s revenue, but by 2030 that figure is expected to fall to just 8 percent. This change highlights OpenAI’s growing financial strength and its determination to retain more resources for its own research, model development, and infrastructure expansion.

Why OpenAI Is Cutting Microsoft’s Revenue Share

The decision to reduce Microsoft’s revenue share reflects several motivations. As OpenAI continues to scale, the costs of building and running powerful AI models remain enormous. By keeping a larger portion of its income, OpenAI can invest more directly into computing capacity, energy supply, and research teams.

At the same time, the company is seeking greater independence, making sure that its reliance on a single corporate partner does not limit its future options. The transition from a heavy dependence on Microsoft to a more balanced partnership represents both financial maturity and strategic foresight.

Microsoft’s Role in OpenAI’s Growth and What May Change

Microsoft has been critical to OpenAI’s growth, providing billions of dollars in funding and access to its Azure cloud computing network. That infrastructure allowed OpenAI to train and deploy large models at a scale that would have been impossible alone.

A reduced profit share, however, may mean Microsoft receives less direct financial benefit in the years ahead.To balance this, Microsoft may in turn focus on strengthening its cloud service agreements with OpenAI. Additionally, it could pursue negotiations for exclusive rights, thereby enabling deeper integration of OpenAI models into flagship products like Office and Windows. By doing so, Microsoft would not only reinforce its strategic positioning but also ensure a competitive edge in the rapidly evolving AI landscape.

OpenAI Restructuring and Nonprofit Oversight of AI Safety

The reduction in revenue sharing is only part of a larger transformation. Reports suggest OpenAI’s nonprofit parent organization could soon hold equity valued at nearly $100 billion in its for-profit entity. This restructuring would allow OpenAI to raise more capital while keeping a governance system in place for issues such as AI safety and ethical use.

Lowering Microsoft’s profit share from 20 percent to 8 percent could allow OpenAI to hold onto tens of billions of dollars over the next decade. Analysts estimate that the company could gain as much as $50 billion in additional retained earnings. This money can be used to expand data centers, train more advanced models, recruit top researchers, and diversify its product offerings.

What the OpenAI and Microsoft Partnership Means for the AI Industry

The decision to change the financial structure of OpenAI’s deal with Microsoft signals a broader shift in the artificial intelligence sector. As AI companies grow more profitable, they are renegotiating old agreements that once seemed permanent. The partnership between OpenAI and Microsoft will likely continue, but in a form that reflects OpenAI’s stronger position.

Other AI companies may follow this example, demanding more favorable terms from their cloud and infrastructure partners. This trend underscores how rapidly the economics of artificial intelligence are changing, and how partnerships in the sector must adapt to new realities.

Apple increases AI investment compete with Google and Microsoft

Apple increases AI investment compete with Google and Microsoft  Microsoft Profits Soar Thanks to Cloud and AI Growth

Microsoft Profits Soar Thanks to Cloud and AI Growth  OpenAI Launches Study Mode Helps Students Learn Better

OpenAI Launches Study Mode Helps Students Learn Better  Microsoft Closes Pakistan Operations After 25 Years

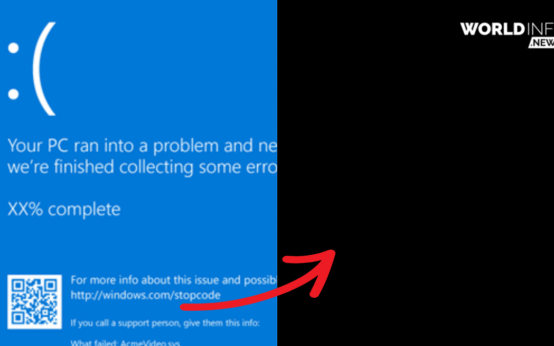

Microsoft Closes Pakistan Operations After 25 Years  After 40 Years, Why Windows Is Killing the Blue Screen?

After 40 Years, Why Windows Is Killing the Blue Screen?  Amazon joins the quantum race with new series of quantum chip

Amazon joins the quantum race with new series of quantum chip