Asian financial markets opened the week with a mix of optimism and caution after Japanese Prime Minister Shigeru Ishiba announced his resignation. Ishiba’s sudden exit followed his coalition’s poor performance in parliamentary elections, leaving uncertainty about Japan’s future leadership. His departure sparked immediate turmoil in currency markets, where the yen weakened sharply, while Japanese equities received a short-term boost.

Global Investors Look to U.S. Federal Reserve for Policy Signals

Beyond Japan, sentiment across Asia was shaped by expectations surrounding the U.S. Federal Reserve. A disappointing American jobs report raised hopes that the Fed would cut interest rates by 25 to 50 basis points in its next meeting. Such a move could ease global financial conditions, reduce pressure on emerging markets, and drive liquidity toward equities.

Asian shares broadly tracked U.S. futures higher, with investors betting that looser monetary policy would support global growth. This interplay between U.S. rate expectations and Asian equity performance highlights the interconnected nature of modern financial markets.

Exporters Reap Benefits from a Weaker Yen

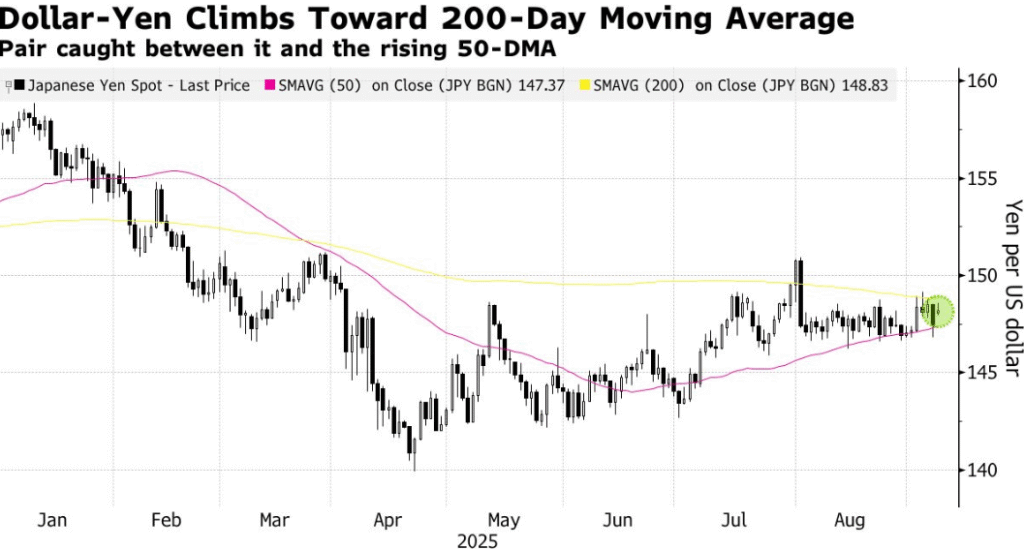

For Japanese exporters, the currency’s decline brought immediate rewards. Automakers, electronics manufacturers, and other export-heavy companies saw their stock prices rise as markets anticipated stronger foreign earnings. The yen’s weakness makes Japanese goods cheaper abroad, giving firms a competitive edge at a time when global demand remains uneven.

The rally was not without risk, however. A prolonged decline in the yen can stoke inflationary pressures at home by increasing import costs for fuel, food, and raw materials. This delicate balance means policymakers will face pressure to stabilize the currency without undermining the competitiveness of exporters.

Political Transition Adds to Fiscal and Monetary Policy Uncertainty

Markets are watching this leadership contest closely. A new prime minister favoring heavy spending could fuel worries about Japan’s already massive debt burden, which exceeds 250% of GDP. At the same time, pressure may build on the Bank of Japan to keep interest rates low, even as bond yields continue to climb.

Consequently, Japan’s government bond market began to reflect this growing unease. In particular, yields on 20- and 30-year bonds surged to record levels, thereby signaling heightened investor concerns regarding the country’s long-term fiscal outlook.

Moreover, as yields continued to rise, borrowing costs for the government inevitably increased; as a result, efforts to manage the world’s largest debt load became even more complicated. In addition to these financial pressures, the upward movement in yields further underscored the delicate balance policymakers must strike between fiscal stimulus and debt sustainability. Ultimately, this confluence of factors illustrates how market reactions, when compounded by structural challenges, can intensify existing vulnerabilities within a national economy.

Regional Market Outlook Balances Optimism and Risk

Across Asia, stock indices largely ended higher thanks to optimism about potential Fed rate cuts and gains for Japanese exporters. Still, the longer-term picture remains clouded by political instability in Tokyo and uncertainty over the yen’s direction.

The outcome of Japan’s leadership race will play a decisive role in shaping fiscal and monetary policies for the months ahead. For now, investors remain cautiously optimistic, taking advantage of short-term equity gains while preparing for possible turbulence in the bond and currency markets.